Commercial Property Market Review – November 2022

Weakening outlook for commercial property

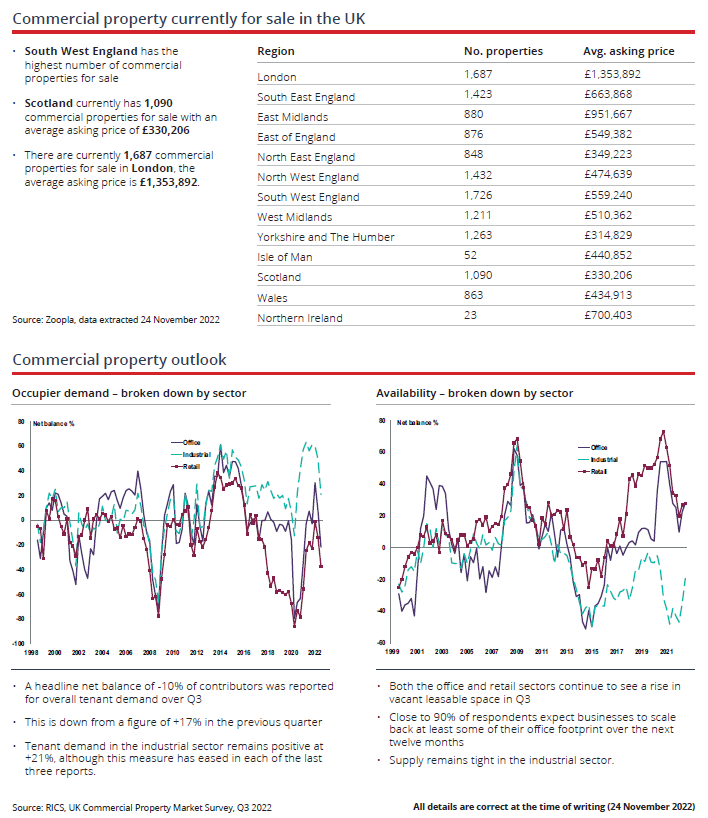

The Q3 2022 RICS UK Commercial Property Survey reveals a picture of weakening market activity, with 81% of respondents now considering the market to be in downturn.

Headline expectations for rents and capital values were in negative territory in Q3. Prime office rents are expected to remain broadly flat in the year ahead, as opposed to a previously expected increase expected. Meanwhile, the outlook for the secondary office sector is more negative, with a net balance of -42% of respondents expecting a decline in rents (down from a reading of -26% in Q2).

Twelve-month rental expectations are still positive for the industrial sector, while the degree to which rents are envisaged rising is the most modest since the early stages of the pandemic.

Looking ahead, the prospect of further interest rate rises continues to weigh heavily on the outlook for the next 12 months. ‘The full extent is not currently known’ commented one respondent.

Prime yields rise in stormy quarter

All-property average prime rents rose by 1.5% in Q3 2022, according to CBRE’s latest quarterly Prime Rent and Yield Monitor.

Yields moved up 41 basis points, following a turbulent quarter that included the market turmoil brought about by September’s ‘mini budget’. The latest Market in Minutes report from Savills also showed yields rising across the board, as commercial markets reprice at speed. The report observes that, ‘price discovery is happening more quickly than we have ever seen before in a falling market’.

Savills remain optimistic about the outlook for the office and logistics occupational markets, noting that these sectors proved their resilience during the turbulent pandemic years, even delivering record prime rent levels in some cases. The same factors that drove this resilience – an undersupply of prime space and a contracting development pipeline – remain in place, it points out.

Less positively, weakening confidence and rising construction prices are leading to fewer-than-expected refurbishment and development starts this year, Savills stated. Indeed, 43% of planned London office completions have not yet started on site.

Strong take-up in big shed market

The industrial sector remains resilient, according to Avison Young’s Big Box Bulletin Q3 2022, with strong market fundamentals holding firm in trying economic conditions.

Take-up in Q3 totalled 14.8m sq. ft – 47.8% above the five-year quarterly average. Analysts expect demand to stay strong, moreover, especially ‘best-in-class’ buildings with strong environmental credentials.

Year-to-date take-up still lags the record-breaking performance of 2021, which, analysts say, is the result of an undersupplied market. Indeed, availability of grade A space is currently 24m sq.ft, equivalent to only two months’ worth of supply based on recent demand.

Key Q3 occupiers included SeAH Wind Ltd (1,130,000 sq. ft), Rhenus Logistics (981,042 sq. ft) and Maersk (601,761 sq. ft). Q3 take-up was dominated by speculative (44%) and design & build (41%), with existing buildings contributing 15%.

Regionally, the East Midlands (30.7%) led the way, ahead of Yorkshire and North East England (23.4%) and North West England (13.4%).

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.